Depreciation Reducing Balance Method

Reducing balance depreciation is one method to reduce the value of fixed assets on the balance sheet. Includes an Excel spreadsheet to calculate the depreciation.

What is Reducing Balance Depreciation?

The reducing balance method, also known as the declining balance method, is one of the primary methods for calculating depreciation in accounting. Other common methods include the double-declining balance and straight-line depreciation methods. Once you choose a method for a fixed asset, you should apply it consistently throughout the asset’s useful life.

The reducing balance method is typically used when an asset loses value more quickly in its early years. For example, machinery or equipment often depreciates sharply right after purchase, with the rate of decline slowing over time. Similarly, a new car loses a significant portion of its value within the first few years.

Depreciation spreads the cost of an asset over time, reducing its value on the balance sheet and recording a depreciation expense in the profit and loss account each month or year.

What Is a Fixed Asset and Why Is Depreciation Important?

A fixed asset is a long-term resource owned by a business, such as machinery, vehicles, buildings, or equipment. These assets are used in day-to-day operations and are not intended for resale. They usually provide value over several years.

Fixed assets are important because they enable businesses to generate income and support their operations over time. However, as they’re used, they gradually wear out or lose value — this is where depreciation comes in. Depreciation spreads the cost of the asset over its useful life, ensuring that the financial statements reflect a more accurate picture of the asset’s current value (net book value) and the actual cost of using it in the business.

Without accounting for depreciation, businesses would overstate the value of their assets and understate their expenses, potentially leading to misleading financial statements and poor decision-making.

Reducing Balance Method vs Straight Line Method

The image uses the data from the example on this page to illustrate the difference between the reducing balance method and the straight-line depreciation method.

As you can see, both methods start at 20,000 and finish with a net book value of 1,500, but the rate at which they reduce is different. It is much faster to start using the declining balance method. Below is a table with the main differences.

| Feature | Reducing Balance Method | Straight Line Method |

| Depreciation Pattern | Decreases over time | Remains constant |

| Calculation basis | Book value each year | Original cost |

| Asset types | Assets that lose value quickly (e.g. vehicles and technology) | Assets with uniform loss (e.g. furniture) |

| Tax implications | Higher deductions in early years | Even deductions over time |

Which Method of Depreciation Should I Use?

Selecting the appropriate depreciation method is crucial for accurate financial reporting and effective tax planning. If an asset, such as machinery or vehicles, loses value quickly in its early years, the reducing balance or double-declining balance method is often the best choice, as it allows for higher expenses upfront. For assets that provide steady value over time, such as buildings or furniture, the straight-line method offers a straightforward and consistent approach.

It’s also important to consider industry standards and stick to the same method throughout the asset’s life for consistency. If you’re unsure which method fits your business, a professional accountant or bookkeeper can help guide you to the best choice.

Depreciation Reducing Balance Method Example

To calculate this method, you need to select a depreciation percentage rate. For our example, we have purchased a new piece of machinery at £20,000 using a 40% rate of depreciation. The asset is depreciated over a period of 5 years and has a residual value of £1500 in the final year.

| Value start of year | Depreciation rate | Depreciation for year | Value of asset at y/e | ||

| Year 1 | £20,000 | 40% | £8,000 | £12,000 | |

| Year 2 | £12,000 | 40% | £4,800 | £7,200 | |

| Year 3 | £7,200 | 40% | £2,800 | £4,400 | |

| Year 4 | £4,400 | 40% | £1,760 | £2,640 | |

| Year 5 | £2,640 | 40% | £1,056 | £1,584 |

As you can see, £ 1,584 remains (net book value) at the end of the 5 years. To obtain the correct figure, you will need to calculate the exact percentage that needs to be used.

Accounting Software to Calculate Reducing Balance Depreciation

Xero accounting Software offers an efficient solution for calculating depreciation. The software enables users to input the initial cost of an asset and its expected useful life, after which it automatically calculates the depreciation amount using the selected method. This ensures accuracy and consistency in recording depreciation expenses. Xero provides a detailed breakdown of the asset’s current value, accumulated depreciation, and book value, enabling more effective asset management.

Once the depreciation is calculated, Xero automatically generates journal entries for the depreciation expense and accumulated depreciation accounts, making it easier to track these transactions in the general ledger. This not only saves time but also reduces errors that may occur when manually posting entries.

How to Calculate Reducing Balance Depreciation

There is a formula for calculating depreciation using the reducing balance method, which is as follows:

DB is a declining balance

Salvage value is the scrap value that you expect to get at the end of its useful life

Cost is the asset cost without VAT

You do not need to know the equation, as our template will calculate depreciation for you.

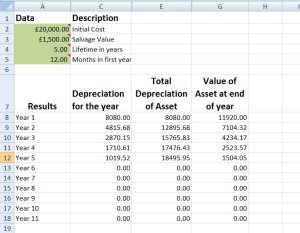

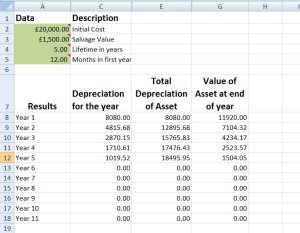

Excel Template – Depreciation Reducing Balance Method

Within Business Accounting Basics, we provide two different calculators to help you calculate your reducing balance method figure. The first reducing balance calculator requires that you know the required percentage rate of depreciation, and it is calculated over 5 years.

The second calculator uses a formula embedded in Microsoft Excel. We have set up a simple spreadsheet that uses the formula to calculate your figures. This Excel template only works if there is a residual value at the end of life up to a maximum period of 10 years.

Instructions for Excel depreciation reducing balance spreadsheet

- Download the declining balance depreciation Excel template.

- Only enter figures in the GREEN boxes.

- Enter the purchase price of the equipment.

- Enter the residual balance – this is the asset’s estimated value at the end of its life.

- Enter the number of years you wish to depreciate the asset over.

- Enter the number of months the assets need to be depreciated during the first year. E.g. If you purchased the asset in January and your year-end is at the end of March, this figure will be 3 months. The template will automatically calculate the number of months in the last year for you.

Once the figures are calculated, they can be used to enter the depreciation into the accounts. Each year, a journal will be entered to adjust the depreciation. The journal will Debit depreciation expense in the profit and loss and credit accumulated depreciation in the balance sheet.

Reducing Balance Depreciation Conclusion

The reducing balance depreciation method, also known as the declining balance method, is a faster way to reduce the value of an asset over its lifetime in the earlier years.

The free Excel spreadsheet provided can help you calculate the figures needed to post your depreciation with this method in your accounting software. If you have a lot of assets, it can save time and ensure all calculations are done correctly.

Return from depreciation reducing balance method to fixed asset page.