Fixed Asset for Small Business

From the delivery van that keeps your business moving to the computer that keeps your records in order, every business relies on fixed assets. They are the tangible or intangible items that allow you to complete business operations. But do you know how to account for them correctly? Do you understand how they impact your business over the long term? If not, then you are in the right place. Let us take a look at the world of fixed assets.

Fixed Asset Definition

The definition of Fixed Asset (FA) is long-term assets a company owns and uses to generate income. These include tangible assets, such as property, plant, and equipment, and intangible assets, such as patents and trademarks, that are not expected to be consumed or converted into cash within one year.

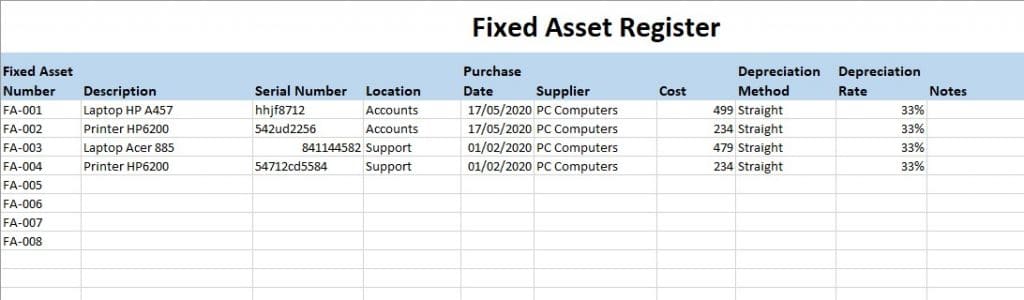

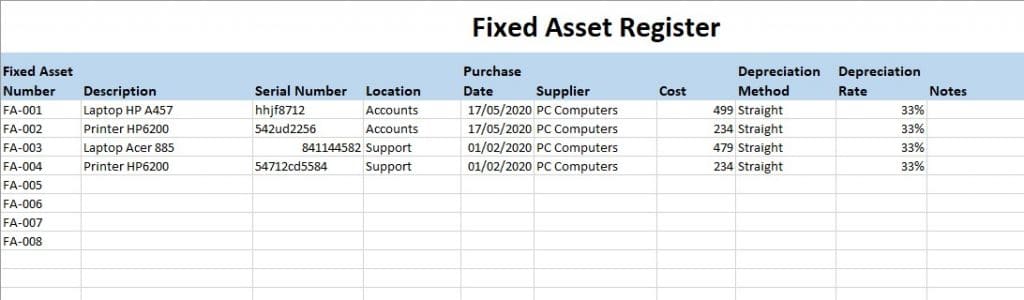

If your business is a limited company, under UK GAAP, you are required to keep accurate financial records, including all your equipment. A fixed asset register can be a simple spreadsheet or a list in a notebook, or if you have many, you may need to use a software package.

Our free Excel Depreciation Schedule is a fixed asset register that calculates your depreciation. We also have a quick depreciation calculator, which calculates depreciation using straight-line depreciation or reducing balance over a given period.

What are fixed assets?

A company’s fixed assets can be broadly categorised into two types: tangible assets and intangible assets.

Tangible Assets

Tangible assets are those physical items a business can touch and see, such as vehicles, machinery, computer equipment, buildings, and furniture. These are typically shown on the company’s balance sheet at their original cost, with depreciation calculated to account for wear and tear over time. To learn more about depreciation and how to calculate depreciation, look at our depreciation accounting section.

Intangible Assets

Intangible assets do not have a physical form but are equally vital to a business operations. Such Assets include goodwill, brands, patents, trademarks, and licenses. While they may be challenging to value, intangible assets can represent a significant portion of a business’s total assets, especially in larger organisations with strong brand recognition.

Tangible and intangible assets are crucial for understanding a company’s financial health and operational efficiency.

Investments

Investments, such as stocks, bonds, and property, fall under the category of assets because they represent resources that a person or company owns with the expectation of generating future income or appreciation in value.

Examples of Fixed Assets

Fixed assets are long-term tangible or intangible property that a company owns and uses to generate income. These assets are not expected to be consumed or converted into cash within one year. Here are some examples of physical assets in small businesses:

- Vehicles: Cars, trucks, and vans used for deliveries or transportation.

- Machinery and Equipment: Computers, printers, manufacturing equipment, tools, etc.

- Furniture and Fixtures: Desks, chairs, shelves, display cases, etc.

- Buildings and Land: Office spaces, warehouses, retail stores, manufacturing facilities.

- Leasehold Improvements: Renovations or upgrades made to a leased property.

Fixed Assets on the Balance Sheet

Fixed assets play a crucial role in a company’s balance sheet. They represent the long-term investments that a business owns and uses to generate revenue. These assets are not intended for quick conversion into cash and are expected to provide benefits over several years, contributing significantly to the business’s operations and financial health.

Fixed Asset Accounting

Fixed asset accounting is a critical aspect of financial management for businesses. It involves tracking, managing, and reporting a company’s long-term tangible and intangible assets. This process ensures that assets like machinery, buildings, and intellectual property are accurately recorded on the company’s balance sheet at their acquisition cost, including any additional expenses necessary to make the assets operational.

Fixed-asset accounting also involves calculating and recording depreciation over time, which reflects the gradual reduction in an asset’s value due to usage and obsolescence.

This depreciation is essential for determining the asset’s net book value, providing a realistic financial picture of the company’s investments. Proper fixed-asset accounting not only aids in compliance with financial reporting standards but also supports strategic decision-making by offering insights into the company’s long-term financial health and operational efficiency.

Fixed Asset Accounting can be complicated; it may be worth speaking to your accountant to find the best way for your business to calculate the costs.

How Fixed Assets Are Recorded

Fixed assets are initially recorded at their acquisition cost, which includes the purchase price and any additional expenses incurred to bring the asset to a usable state, such as installation or transportation fees. This total cost is then reflected on the balance sheet under non-current assets, distinguishing them from current assets like cash and inventory.

Depreciation and Net Book Value

Over time, fixed assets undergo depreciation, which is the gradual reduction in their value due to wear and tear or obsolescence. Depreciation is accounted for in the financial records to allocate the asset’s cost over its useful life, providing a more accurate representation of its value. The accumulated depreciation is subtracted from the asset’s original cost to determine its net book value, the amount shown on the balance sheet.

Recording the Depreciation Journal Entry

A business typically makes a journal entry at the end of each accounting period to record depreciation. The entry involves two accounts:

- Depreciation Expense Account: This account is debited to reflect the expense incurred from the asset’s depreciation during the period. It appears on the income statement, reducing the company’s net income or profit.

- Accumulated Depreciation Account: This account is credited on the balance sheet. It accumulates the total depreciation expense over the asset’s life, reducing the asset’s net book value.

Example of a Depreciation Journal Entry:

- Debit: Depreciation Expense (Income Statement)

- Credit: Accumulated Depreciation (Balance Sheet)

Disposal of Fixed Assets

The disposal of fixed assets is an essential aspect of fixed-asset accounting. It involves removing an asset from the company’s balance sheet once it is no longer used, missing, or sold. This process ensures that financial records accurately reflect the current state of a company’s assets.

Steps in the Disposal Process

- Determine the Asset’s Book Value: Before disposing of a fixed asset, it’s crucial to calculate its net book value. This is done by subtracting the accumulated depreciation from the asset’s original acquisition cost.

- Assess the Disposal Method: Fixed assets can be disposed of in various ways, including selling, scrapping, or donating. The chosen method will impact the accounting treatment and any potential gain or loss on disposal.

- Record the Disposal Transaction on the Financial Statements: Once the asset is disposed of, it’s necessary to record the transaction in the financial records. This involves removing the asset’s cost and accumulated depreciation from the balance sheet and recognising any gain or loss on the income statement.

Example of Disposal Accounting

Suppose a company sells a piece of machinery for £5,000. The original cost of the machinery was £10,000, and it has accumulated depreciation of £7,000. The net book value is £3,000 (£10,000 – £7,000). The sale results in a gain of £2,000 (£5,000 – £3,000), recorded as follows:

| Debit | Credit | |

| Cash/Bank | 5,000 | |

| Accumulated Depreciation | 7,000 | |

| Fixed Asset | 10,000 | |

| Gain on disposal of Asset | 2,000 |

If a fixed asset has been sold or withdrawn from use, you will need to calculate the disposal of fixed assets figure and post it to the accounts.

Tangible items are usually calculated by taking their purchase value and reducing it by depreciation over time. For example, a small business purchases a computer for 600. They depreciate the computer over three years; therefore, the depreciation will be 200 per year.

Download our free depreciation schedule Microsoft Excel template for your fixed asset schedule.

Intangible Assets are more complex to value as they have no fixed costs; it is best to seek the help of an accountant for valuation.

Importance of Financial Analysis

Fixed assets on a balance sheet are vital for financial analysis as they indicate the company’s investment in long-term resources. Analysts and investors closely examine these assets to assess the business’s potential for generating future revenue and its ability to sustain operations. A well-maintained portfolio of fixed assets often suggests a strong foundation for continued growth and profitability.

Fixed Asset Software

When choosing the right asset software package, you have several options. If you’re already using an accounting package, it’s worth checking if it includes features for managing fixed assets, as many paid software solutions do. For instance, Xero offers a comprehensive setup that allows you to establish a fixed asset register and calculate depreciation. This integration can streamline your fixed asset accounting processes, ensuring accuracy and ease of management.

If your company is larger and requires precise tracking and valuation of fixed assets, specialised software packages are available. Apps that integrate with XERO can also make the whole process easier.

Fixed Asset tracking

There are several ways to complete fixed asset tracking. As a one-man band, you will know where the equipment is. If you have a couple of employees, giving each piece of equipment a sticker with a unique number may be suitable.

A larger company may have many assets, making it worth investing in fixed asset tags or labels. Some of these will include a barcode, which can be read with a barcode reader, and the equipment will then be identified.

We have written a short guide on barcode asset tracking; this explains how barcodes and scanners can work with all your assets.

Fixed Asset Turnover Ratio

The fixed asset turnover ratio is a financial metric that measures how efficiently a company uses its fixed assets (like property, plant, and equipment) to generate sales revenue. Here’s a breakdown:

What it measures:

- It tells you how much revenue a company generates for every pound invested in its fixed assets.

- A higher ratio generally indicates that a company effectively utilises its fixed assets to produce sales.

How a Fixed Asset Turnover Ratio is Calculated:

The formula is:

Fixed Asset Turnover Ratio = Net Sales / Average Fixed Assets

A manufacturing business has sales of 200,000, the opening fixed assets are 10,000 and closing 14,000. The calculation is as follows:

200,000 / (8,000 + 12,000 / 2) = 200,000 / 10,000 = 20

The business, therefore, generates a revenue of 20 for each pound invested in fixed assets.

Why it’s important:

- Efficiency Assessment: This helps investors and analysts assess how well a company manages its fixed assets.

- Performance Comparison: It compares a company’s efficiency over time or with its competitors.

- Investment Decisions: It can aid in investment decisions by providing insights into a company’s ability to generate revenue from its assets.

Conclusion

In conclusion, fixed assets are a vital business component, supporting daily operations and long-term growth. Businesses can make informed decisions that enhance financial health and operational efficiency by understanding the different types of fixed assets, such as tangible and intangible assets, and their role on the balance sheet.

Proper fixed asset accounting, including tracking, depreciation, and disposal, ensures accurate financial reporting and aids strategic planning. Effectively managing these assets can lead to improved cash flow, better investment decisions, and sustained business success. Whether you’re a small business owner or part of a larger organisation, grasping the basics of fixed assets is crucial for achieving your financial goals.

Return from fixed asset to bookkeeping basics page.